Have questions About the Process of Registration

with Encompass Pay?

Start saving on credit card processing fees today.

Fill Out the form below and Book your free consultation now.

Get Encompass Pay FREE CONSULTATION

From $5,000 – $2MM

Want to know what your options are?

Credit Card Processing Fees getting to be too much?

We're glad you're here.

Our Process

One-Page FareCharging PDF

Covers the value proposition of FareCharging, businesses can save up to 90% off their current processing fees with fully compliant technology.

EP White Paper

History of surcharging with real-world case studies and data trends.

CFO Article

: Survey of CFOs by FTI Consulting, 42.6% of CFOs surveyed listed operational improvements as a way to increase financial performance in 2023. FareCharging is tailor-made to allow businesses to do exactly that, with zero upfront cost while driving significant bottom-line savings.

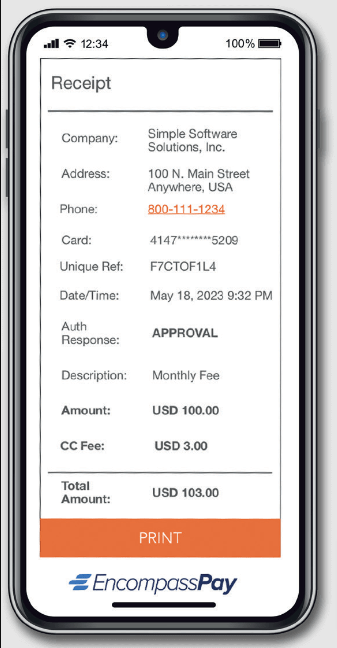

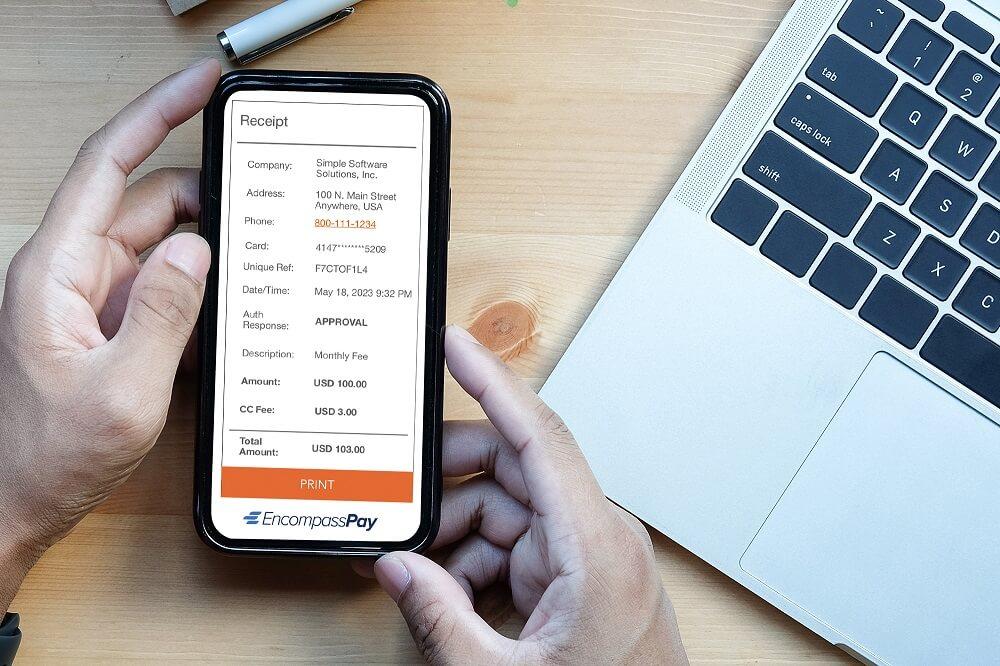

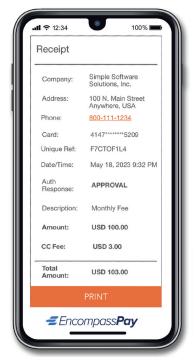

UI Screenshots

Snapshot of standard UI, Dashboard, Reports, and Payment Page. All functionality can be accessed via our flexible API for a more customized solution

Save up to 90% on Processing Fees in Four Easy Steps

1

Save up to 90% off current processing fees by passing a fee on every credit card transaction.

2

Zero upfront/setup costs.

3

Fully legal and compliant technology ensures your business follows the card network rules as well as individual state laws.

4

Out-of-the-box solution for easy implementation with a robust API available for a more customized application if needed.

EncompassPay Solution

Credit Card FareCharging

New rules allow businesses to add a fee to each credit card transaction. This converts high processing fees into bottom-line savings. These are the components of the credit card farecharging solution at Encompass Pay. Finally a process that’s fair for all parties.

Boost your bottom line and profitability instantly Zero upfront costs Proprietary technology that ensures full compliance Seamless OmniChannel experience for all payment environments Simple and easy API integration when applicable Consumers can pay with No-Fee options including debit cards, cash, or ACH/check

Convert the high cost of accepting payments into bottom-line savings.

FareCharging creates a level playing field for everyone.

Boost your Bottom Line. Elevate your Success.

• ZERO upfront costs

• Save up to 90% o your current processing fees

• Stop paying for your customers rewards programs

Compliance Driven by Technology

• Required disclosure provided for all payment environments

• 3% Fee added to every credit card transaction

• The fee is ONLY added to Credit Cards not Debit Cards

• The Fee is broken out as a line item on the receipt

Keep it Fair. Keep it Simple.

• Customers always have no-fee payment options including;

Debit Cards, ACH/Check, and Cash.

• Omni-Channel solution provides acceptance across all payment

environments; Online, In-Person, and Keyed transactions

• API available for customizing the user-experience with Scalability,

Flexibility, and Real-Time data syncing.

Save up to 90% on Processing Fees in Four Easy Steps

Submit 1 or 2 recent Processing Statements

We conduct a comprehensive savings analysis

Our team processes your application

Now the money goes in the right pocket. Yours.

The Rules have Changed

Overview

Accepting credit cards for payment of goods and services is a double edged sword for businesses in the U.S. On the plus side, it makes it easier for consumers to pay and typically increases the amount of the sale. The problem is the cost to accept plastic is one of the largest avoidable line-item expenses businesses incur and increases on a

regular basis.

The purpose of this white paper is to provide insight for businesses on how to eectively mitigate the costs of credit card acceptance resulting in a direct increase in profitability and EBITDA.

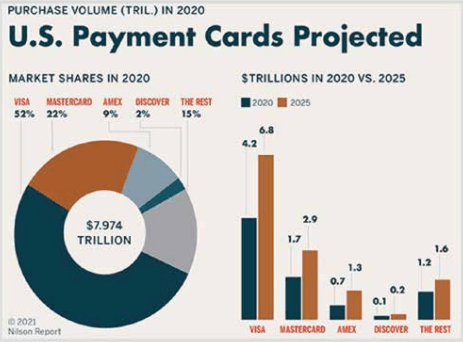

Credit Card Usage in the US

According to a 2021 Nilson Report (1), U.S payment card purchase volume will grow from $7.9 Trillion in 2020 to an estimated $12.8 trillion dollars in 2025, a whopping $4.9 trillion dollar increase.

2023 Global CFO Survey Regional Highlights

Start saving on credit card processing fees today. Fill Out the form below and Book your free consultation now."